Customer Lifetime Value – or: Why is the customer value important?

The question of how much is a customer value isn’t new. Nor is it the KPI (Key Performance Indicator) of the Customer Lifetime Value (CLV). Nevertheless, it is often not used effectively enough – even though it should become more and more important. Because with it you can focus on your important customers or, for example, compare your marketing budget sensibly with your profit. What you know about CLV and why you should use CRM software for it, read right now.

Table of Contents

Definition: What is Customer Lifetime Value?

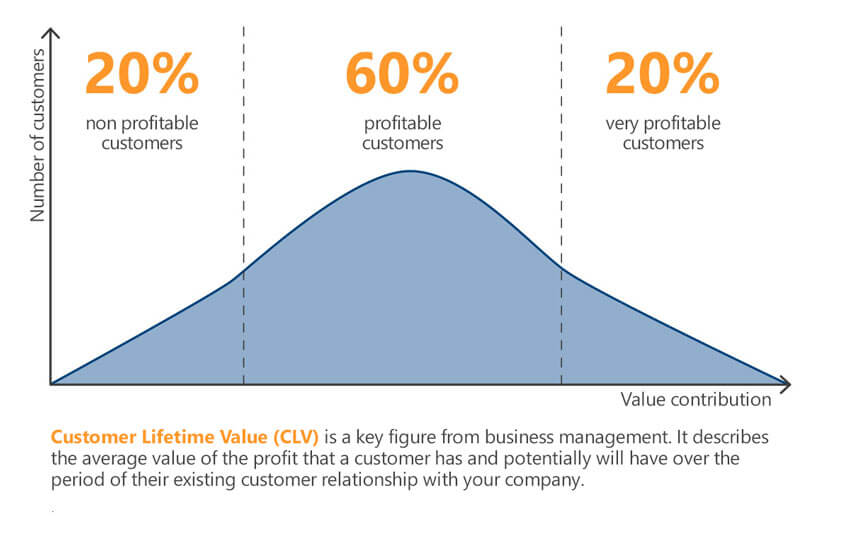

The Customer Lifetime Value (CLV) is a key figure from business administration. It describes the average value of profit that a customer has and will potentially have over the period of their existing customer relationship with your company.

Depending on how the value is calculated, it can be used differently by you. For example, it can serve as a key figure for monitoring customer value development, e.B. to control the success of your CRM strategy and thus the CRM system. Marketing and sales also use the CLV for budget planning for acquisition and marketing measures. It makes a difference whether a single customer or an entire segment is considered.

Why is customer lifetime value important? What does it have to do with CRM?

Customer Lifetime Value is so important because it helps companies to make a more holistic assessment of their customers than purely transaction-oriented – i.e. fast-turnover – approaches make it possible. The focus here is on the customer relationship level and the customer potential, not on the timely generated revenue.

Thus, this key figure provides a valuable basis for estimating the profitability of investments in a customer relationship. This is one of the reasons for the close connection of the CLV with Customer Relationship Management. The CLV makes it clear that a long-term customer relationship can be much more valuable than a short relationship with a one-time high turnover. It is not for nothing that the rule of thumb is that acquiring a new customer is about five times as expensive as retaining a single existing customer.

How do I calculate the Customer Lifetime Value?

There are many ways to calculate the customer lifetime value. Depending on which company wants to use the key figure and how, different influencing factors can be used or more or less complex calculations can be made.

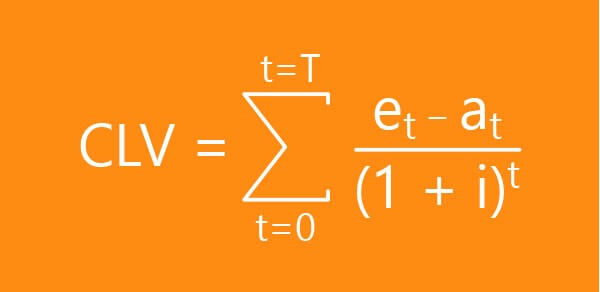

The simplest form of calculation is based on the net present value method.

First, you think about which time period should be considered and how long the business relationship is likely to last. From the expected turnover and the expected investment, the coverage amount that your customer achieves is calculated for such a period. The calculation interest rate serves the comparability of payments that are due at different times.

For this purpose, the following variables are used:

- T: expected duration of the business relationship

- t: Time period of observation (years, months, days)

- et: expected turnover of the business relationship for period t

- at: expected investment in the business relationship for period t (e.B. marketing, consulting, etc.)

- i: Calculation interest rate based on the duration of the customer relationship

An example of the calculation of CLV

A simple example illustrates the procedure for calculating the customer lifetime value. Let’s say a mechanical engineering company wants to plan its marketing budget for the coming year and use the CLV as a basis for this.

The average customer relationship of the mechanical engineering company lasts about 10 years, which results in a calculation interest rate of 10%. On average, the company replaces a machine with its customers every 5 years and thus has a revenue of 10,000 €. Every year there is a maintenance worth 1,000 €. This results in an expected turnover of €40,000 over a period of 10 years. So that’s an average of €4,000 per year – our observation period. The costs for service and management of customers amount to an average of 800€ per year. This gives us the following values for the calculation:

- T = 10 years

- t = 1 year

- et = 4.000€

- at = 800€

- i = 0.1

The customer lifetime value for the coming year would be €3,200. The CLV for the next 10 years about 22,863 €. These figures can now be used by the marketing team for the budget planning of the coming year to estimate how much should be invested in the customer.

For the many individual cases of different business models and applications, the calculation can be adapted. Most companies develop their own formulas that are tailored to their specific business model and the associated customer behavior. This usually means that other factors are included.

Significant influencing factors for your calculation of CLV can be

- Customer’s turnover

- Purchase interval

- Average repurchase rate

- Customer acquisition costs

- Costs for customer-binding measures

- Average customer relationship duration

- Offers and discounts

- Costs for marketing campaigns

- Special contracts

- Average contract terms

- Seasonal fluctuations

- Cross- and up-selling potentials

- Length of the previous business relationship

Into the future with CRM

Now, of course, you can’t look to the future. So how are you supposed to know how long a business relationship will last or how much revenue your customer will bring?

In order to be able to make estimates for these values, it is worthwhile – if possible – to look into the past and to resort to experience or average values. At this point, a CRM system with a comprehensive 360° history of your customers pays off.

A dashboard for management that prepares these figures saves you from compiling, preparing and displaying the figures you are looking for. For this purpose, a software for dashboards & reports is an integral part of a CRM system.

How high should a good customer lifetime value be?

There is no concrete figure for a good customer lifetime value. However, it can be said that a positive CLV speaks in favour of putting money into maintaining the customer relationship. A negative CLV rather signals that the budget should be cut better if necessary.

But it can also serve as a signal for the type of measures: Customers identified as profitable are maintained and, if possible, tied to the company. Less profitable customers are instead addressed with up-selling offers in order to make them profitable.

CLV and CAC

For the interpretation of the CLV, it is worthwhile to include another key figure in the consideration: the Customer Acquisition Cost (CAC).

What is the Customer Acquisition Cost (CAC)?

The CAC describes the costs incurred in the acquisition of new customers of a company in relation to the individual customer and, in addition to the CLV, is a valuable factor for assessing the acquisition and customer loyalty measures.

How to calculate the Customer Acquisition Cost?

The CAC is calculated relatively simply: The total costs of the acquisition measures in marketing and sales are divided by the actually won customers in a defined period of time.

What does the relationship between CLV and CAC say?

Simply put, CLV and CAC tell you how much you spend on a customer and how much they give you back. And what should a good ratio of CLV and CAC look like?

It stands to reason that it looks rather bad for you if your CAC is higher than your CLV. This means that you spend more on attracting a customer than you earn later with him. If the ratio is balanced (1:1), at least do not make any losses. But nothing more than that. In these cases, you should urgently work on your marketing and sales strategies.

Attention! Ironically, however, there is also a need for action when their CLV is much higher than their CAC. This is an indicator that you are not showing your valuable customers enough that you appreciate them. This could lead to difficulties.

How do I improve customer lifetime value?

The possibilities are manifold. A good approach would be to critically examine the customer centricity of the company and then work on optimizing customer relationships. Try to get answers to the following questions, e.B. through surveys:

- How satisfied are your customers?

- What do you expect in terms of your products or services?

- What about your business?

- Have you selected the right contact points for your customers and are you offering the right content there (customer journey)?

- What is the experience of your customers at individual contact points, e.B. in customer experience on the phone?

- etc….

While customer centricity should be deeply rooted in your corporate culture, tools like CRM systems can help you make processes and interactions as pleasant and accommodating as possible for customers. As mentioned above, CRM software provides a comprehensive database for calculating your CLV over time.

Advantages and disadvantages of customer lifetime value

With all the advantages of clV mentioned, it naturally also has some disadvantages that must be weighed against the advantages.

Benefits of Customer Lifetime Value

- The focus is on achieving long-term profitable customer relationships by considering their entire lifespan.

- An objective metric of customer value also allows for an objective estimation of the ROI of investments in the customer relationship.

- The CLV provides a basis for controlling and optimizing budget and resource planning.

Disadvantages of CLV

- Despite all the holistic approach, clV is a key figure based on forecasts. These are always associated with a certain uncertainty and a risk. However, the longer the customer’s purchase history is included, the lower the risk of an incorrect assessment.

- Privacy policies make it difficult to collect and process required customer data for the benefit of customer privacy. This must be done anonymously, which presents some companies with challenges.

- Especially when calculating an average CLV, it should be borne in mind that the behavior and thus the value of individual customers can deviate greatly from the average. In this case, the justification of measures on the basis of the CLV should be carried out with caution.

Conclusion

Customer Lifetime Value is a great metric for taking a holistic view of your customers. Nevertheless, you should understand them comprehensively in order to be able to apply them sensibly. The better your database is maintained, the more meaningful your calculations will be.